AUD/USD bulls back in control following Fed

- AUD/USD is on the bid following the Federal Reserve interest rate decision and statement.

- Markets will now hear from Fed's chair Powell.

AUD/USD has recovered from the surprise miss in the Consumer Price Index where the market fell to a low of 0.7725 on a spike to the downside.

The price is now heading higher as the dollar gives way to a low of 90.71. AUD/USD is trading at the highs of the day of 0.7789 as Federal Reserve's chair Powell takes the stand.

The statement has said that the Fed will continue increasing bond purchases by at least $80 bln/month of treasuries, $40 bln/month of MBS until 'substantial further progress' has been made on maximum employment and price stability goals.

Meanwhile, the benchmark interest rate was unchanged with the target range standing at 0.00% - 0.25%

with the interest rate on excess reserves also unchanged at 0.10%.

Fed's chair Jerome Powell is expected to maintain the status quo in rhetoric.

Markets are starting to look for signs of tapering and Powell will surely be asked about the timing.

AUD/USD technical analysis

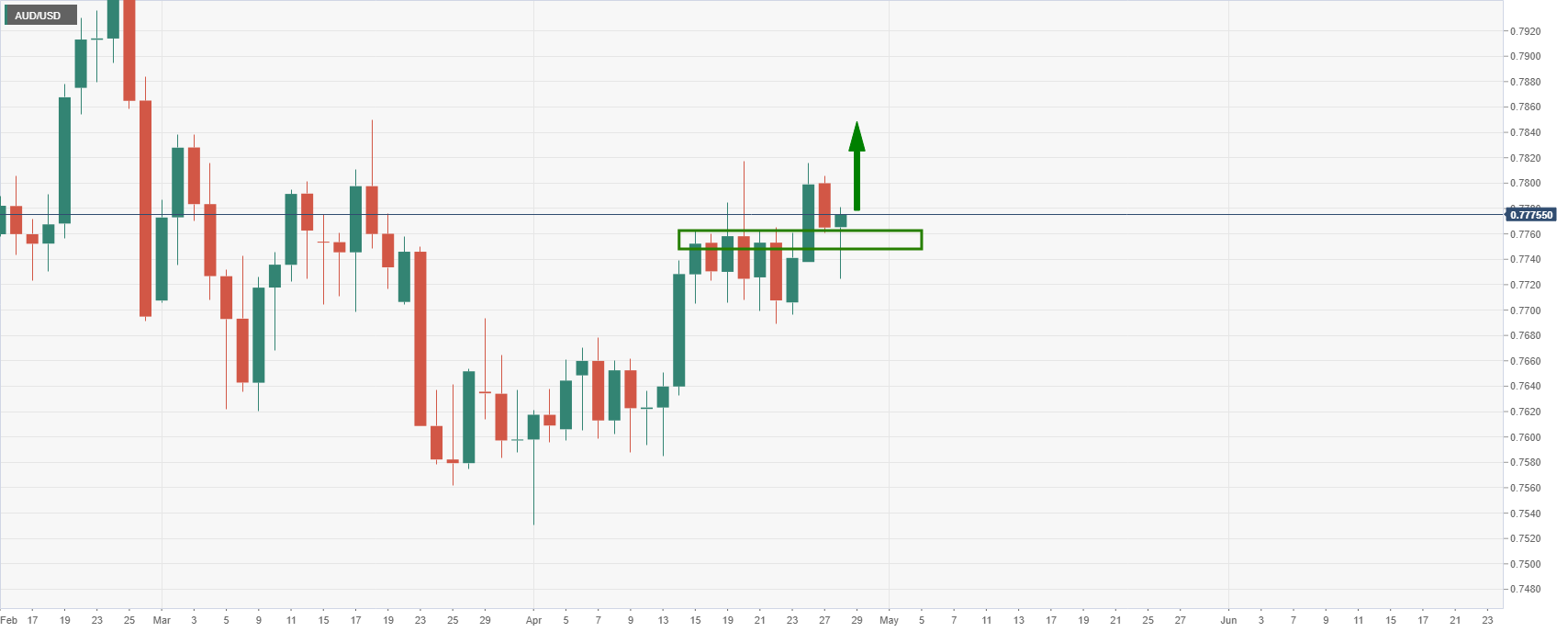

As per the analysis in Breaking: Aussie CPI mainly in below expectations, AUD pressured, the market has indeed respected the support structure, despite a brief spike to the downside, and is resuming the upside trend as follows:

Prior analysis

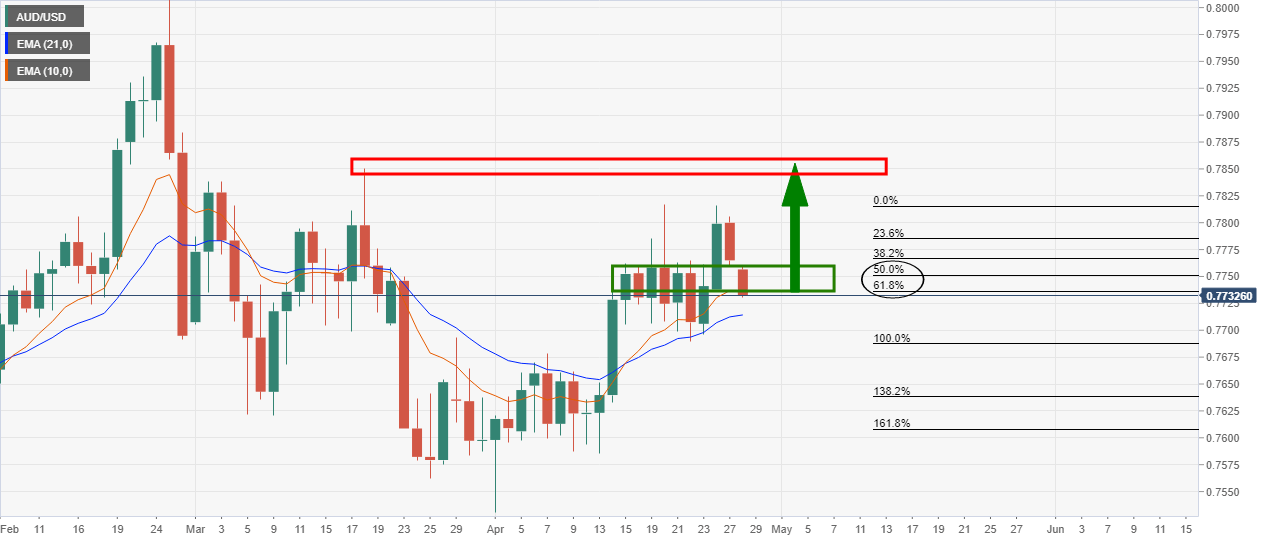

From a longer-term perspective, the daily chart shows that the price may stall on the offer at an important structure of confluence where the 61.8% Fibo meets the 10-day EMA as a keen target to the downside within the support structure that would be expected to be the last defence.

Live market, daily & hourly

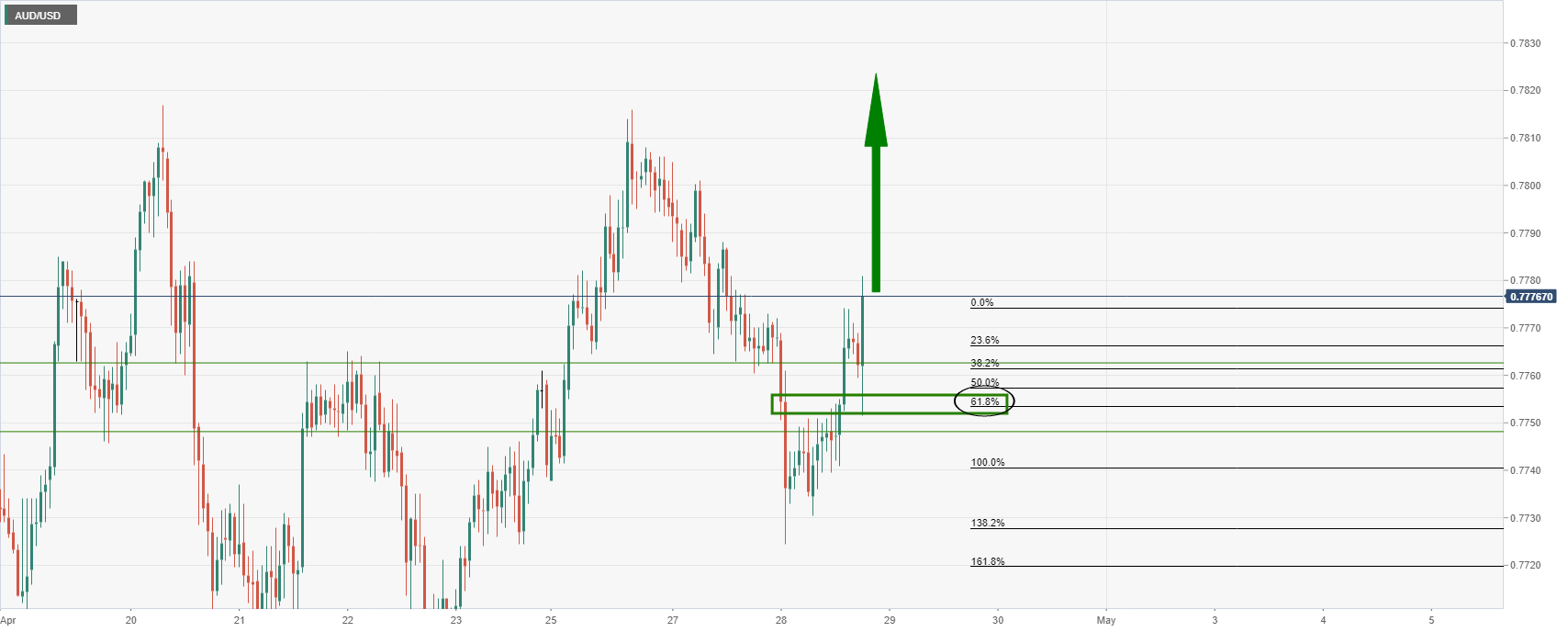

Hourly chart