Gold Price Analysis: XAU/USD refreshes two week high on the way to $1,890 – Confluence Detector

Gold refreshes a fortnight high while piercing $1,870, currently up 0.30% around $1,869, during the pre-European session trading on Tuesday. The yellow metal recently benefited from the extension of mild risk aversion as well as the US dollar’s failures to keep the previous two days’ recovery moves.

The risks turned heavy as the US-China tussle intensifies after the Trump administration announced fresh sanctions on diplomats from Beijing while Hong Kong police arrested a few more of the opposition leaders. Further, worsening coronavirus (COVID-19) conditions in the US, Tokyo and Hong Kong dim vaccine hopes while uncertainty surrounding Brexit and US stimulus keep traders cautious and favor the yellow metal.

On the other hand, Japan’s third stimulus to combat the pandemic and Chinese Foreign Minister Wang Yi’s optimism for the Phase 2 deal talks with US President-elect Joe Biden couldn’t recall the bulls amid a light calendar.

Moving on, traders will keep their eyes on the Brexit headlines while stimulus updates and virus/vaccine news can add to the market players’ entertainment. Additionally, further worsening of the Sino-American relations can escalate risk-off mood and may recall the $1,900 on the chart.

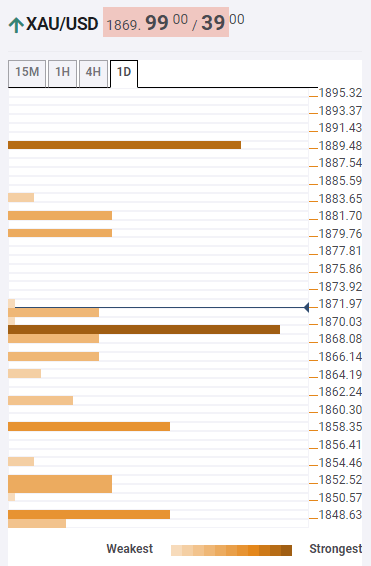

Gold: Key levels to watch

A sustained break of $1,869 gives a green pass to the gold buyers targeting $1,890 upside resistance, comprising 61.8% Fibonacci retracement level on the one month (1M).

Though, SMA 50 on one day (1D) and Pivot Point one-day (D1) Resistance 1, respectively around $1,880 and $1,882, can offer an intermediate halt during the north-run.

Meanwhile, a downside break of $1,869, which is the convergence of the Pivot Point one-week Resistance 1, previous high on D1 and the Simple Moving Average 5 on 15-minutes, will recall the sellers targeting $1,857 that includes Simple Moving Average 5-4H and Fibonacci 23.6% one-day.

Here is how it looks on the tool

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence