Back

14 Feb 2020

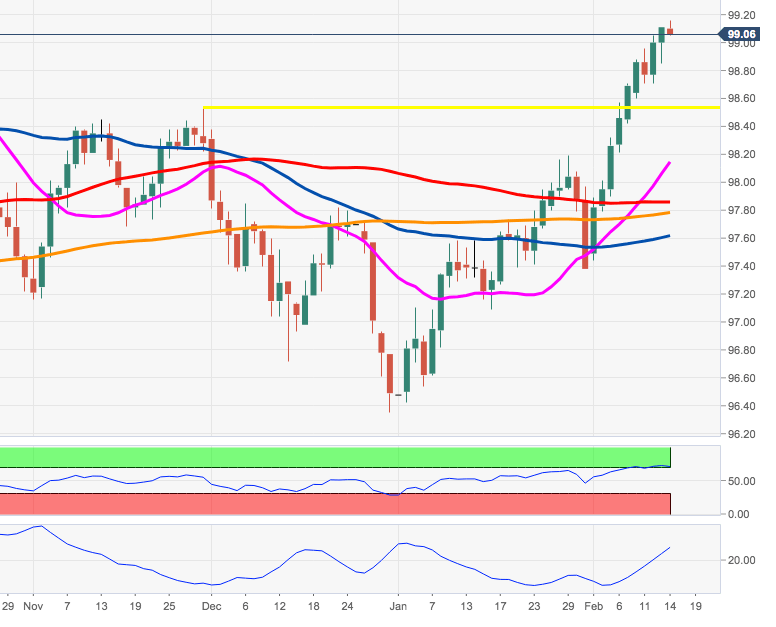

US Dollar Index Price Analysis: Correction lower could test the mid-98.00s

- The rally in DXY run out of some steam above the 99.00 mark.

- There is scope for the downside to extend to the 98.54 level.

DXY is shedding some ground after reaching fresh yearly peaks in the proximity of 99.20 earlier on Friday.

The current overbought levels in the dollar coupled with the strong rally carry the potential to spark a correction lower to, initially, the November 2019 top at 98.54 in the near-term.

Looking at the broader picture, the constructive perspective on the dollar is seen unaltered as long as the 200-day SMA at 97.76 underpins.

DXY daily chart