EUR/USD struggling to extend gains above 1.06

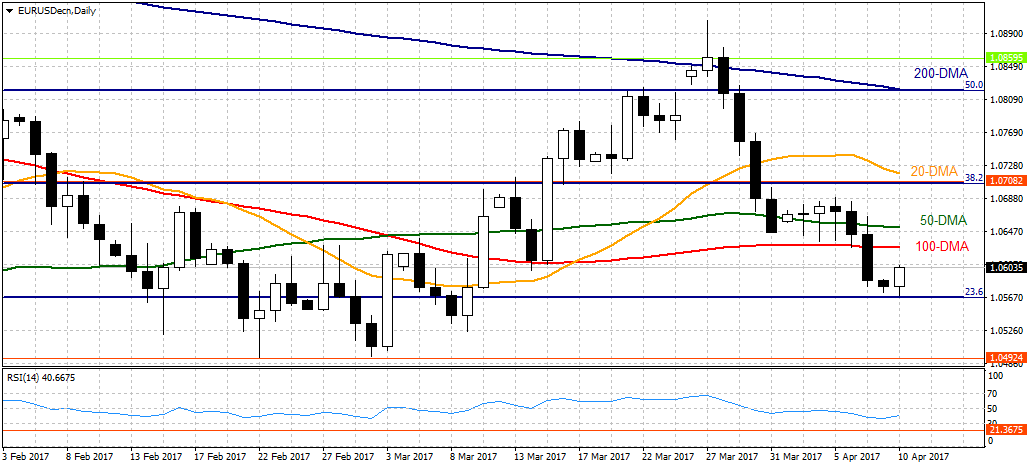

The EUR/USD pair rose above the 1.06 handle during the American session but is having a hard time gathering a bullish momentum as the markets are waiting for a fresh catalyst. At the moment, the pair is up 0.12% at 1.0604.

Although the pair fell to a fresh one-month low at 1.0570 during the European session, it was able to find support there as the US Dollar Index struggled to break above the 101.20 handle. U.S 10-year Treasury yield is putting a cap on the greenback's gains as it's recording a 0.8% daily drop at 2.35%.

Now the participants await Federal Reserve Chair Yellen's remarks for fresh impetus. Yellen will start speaking at 20:00 GMT and she won't be giving a prepared speech at the University of Michigan, and this event has the potential to be a market mover. Yellen will be answering questions from the audience and via Twitter following her speech.

Tomorrow's economic docket will feature the ZEW survey results from Germany and the euro area. Later in the day, FOMC's Kashkari will be giving a speech during the first half of the NA session.

Technical levels to consider

The 100-DMA at 1.0630 is the first hurdle for the pair followed by 1.0700 (psychological level) and 1.0760 (Mar. 24 low). On the flip side, with a breach of 1.0570 (daily/monthly low), the pair could aim for 1.0455 (Jan. 11 low) and 1.0390 (Jan. 4 low).

- EUR/USD: Anticipate new rallies towards the 1.0730 barrier - Natixis